lv discretionary trust form | Lv survivorship clause lv discretionary trust form How to use our Online Trusts tool. You’ll see some questions – as you answer . $4,899.00

0 · life insurance trust registration

1 · Lv trusts

2 · Lv survivorship clause

3 · Lv life insurance trust

4 · Lv advisor trusts

5 · Lv advisor trust registration

Certified. Includes Buyer Protection. North and South America. United States of America. Europe. Watch with original box and original papers. to $5,200. to $5,700. from $5,700. Dial: Gold. Dial: Champagne. Dial: White. 1980's. 1970's. Quick Set. Chronometer. Central seconds. }"> 599 listings including promoted listings. Sort by. Promoted.

LV='s document library lets you download, save and email files - directly to you and your clients. Find key information, product profiles and more here.Trusts related to in-force LV= protection plans that don't hold a surrender value .Guide to trusts for Business Protection. Find a summary of our types of trust, along .

How to use our Online Trusts tool. You’ll see some questions – as you answer .Whether you're a financial adviser or a LV= member this tool will help you choose the right online trust form for your (or your client's) policy. Simply answer the questions and you will be .With discretionary trusts, more of the decisions are made by the trustees but you also don’t have to fix in beneficiaries, the sum received or when the beneficiaries will receive it. Once you have .

Trusts related to in-force LV= protection plans that don't hold a surrender value won't need to be registered. Trusts containing other types of policy may need to be registered. For further .To help you put your Life Insurance policy in trust, you can use our Online Trusts tool. You will be asked a few basic questions about your circumstances, then based on your answers, the tool .

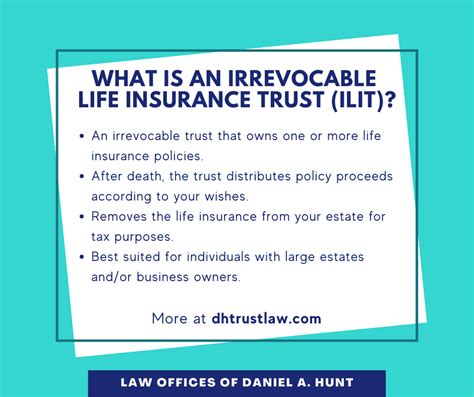

We’ve put together a list of frequently asked questions to help support you. If you have any queries or need help with the registration process, please visit gov.uk/guidance/register-a-trust . Knowing the differences between common kinds of trusts can help you choose the best trust for your estate. Living Trusts: A living trust can be revocable or irrevocable. . A support trust includes language stating that the trustee should pay the beneficiary as much trust income and/or principal as the beneficiary needs for his or her .

life insurance trust registration

Guide to trusts for Business Protection. Find a summary of our types of trust, along with key documents and accompanying guides.How to use our Online Trusts tool. You’ll see some questions – as you answer them, results will be filtered, leaving the most appropriate trust form available. Complete the details on the trust . LV='s document library lets you download, save and email files - directly to you and your clients. Find key information, product profiles and more here.Whether you're a financial adviser or a LV= member this tool will help you choose the right online trust form for your (or your client's) policy. Simply answer the questions and you will be directed to a form that you can fill out and sign using your mouse or touch screen.

With discretionary trusts, more of the decisions are made by the trustees but you also don’t have to fix in beneficiaries, the sum received or when the beneficiaries will receive it. Once you have passed away the trustees will then make the decision on who gets what and when.Trusts related to in-force LV= protection plans that don't hold a surrender value won't need to be registered. Trusts containing other types of policy may need to be registered. For further information, please see our Trust Registration Service FAQs.

To help you put your Life Insurance policy in trust, you can use our Online Trusts tool. You will be asked a few basic questions about your circumstances, then based on your answers, the tool will provide you with the most appropriate of our in-house trust deeds.

We’ve put together a list of frequently asked questions to help support you. If you have any queries or need help with the registration process, please visit gov.uk/guidance/register-a-trust-as-a-trustee or call the HM Revenue & Customs (HMRC) Trustee helpline on 0300 123 1072. Knowing the differences between common kinds of trusts can help you choose the best trust for your estate. Living Trusts: A living trust can be revocable or irrevocable. Revocable trusts: can be altered by the trustmaker (i.e. “revoked”) while the trustmaker is . A support trust includes language stating that the trustee should pay the beneficiary as much trust income and/or principal as the beneficiary needs for his or her support and education. Support trusts can be distinguished from discretionary trusts, for which the trustee pays out distributions on a discretionary basis (such as on request of the .

Guide to trusts for Business Protection. Find a summary of our types of trust, along with key documents and accompanying guides.How to use our Online Trusts tool. You’ll see some questions – as you answer them, results will be filtered, leaving the most appropriate trust form available. Complete the details on the trust form – you’ll also be able to share the form with settlors, trustees and witnesses.

LV='s document library lets you download, save and email files - directly to you and your clients. Find key information, product profiles and more here.Whether you're a financial adviser or a LV= member this tool will help you choose the right online trust form for your (or your client's) policy. Simply answer the questions and you will be directed to a form that you can fill out and sign using your mouse or touch screen.

Lv trusts

With discretionary trusts, more of the decisions are made by the trustees but you also don’t have to fix in beneficiaries, the sum received or when the beneficiaries will receive it. Once you have passed away the trustees will then make the decision on who gets what and when.Trusts related to in-force LV= protection plans that don't hold a surrender value won't need to be registered. Trusts containing other types of policy may need to be registered. For further information, please see our Trust Registration Service FAQs.To help you put your Life Insurance policy in trust, you can use our Online Trusts tool. You will be asked a few basic questions about your circumstances, then based on your answers, the tool will provide you with the most appropriate of our in-house trust deeds.We’ve put together a list of frequently asked questions to help support you. If you have any queries or need help with the registration process, please visit gov.uk/guidance/register-a-trust-as-a-trustee or call the HM Revenue & Customs (HMRC) Trustee helpline on 0300 123 1072.

Knowing the differences between common kinds of trusts can help you choose the best trust for your estate. Living Trusts: A living trust can be revocable or irrevocable. Revocable trusts: can be altered by the trustmaker (i.e. “revoked”) while the trustmaker is . A support trust includes language stating that the trustee should pay the beneficiary as much trust income and/or principal as the beneficiary needs for his or her support and education. Support trusts can be distinguished from discretionary trusts, for which the trustee pays out distributions on a discretionary basis (such as on request of the .Guide to trusts for Business Protection. Find a summary of our types of trust, along with key documents and accompanying guides.

orange dust bag hermes card

hermes croco orange

The Rolex Datejust: Popular Variants at a Glance. Rolex Datejust 36: Diameter of 36 mm, available in stainless steel and two-tone versions, Jubilee or Oyster bracelet, fluted, polished, or diamond-set bezel; Rolex Datejust 41: Diameter of 41 mm, available in stainless steel and two-tone versions, Jubilee or Oyster bracelet, fluted or polished bezel .

lv discretionary trust form|Lv survivorship clause